Hold or Fold: Risk Management Wisdom from October’s Crypto Whiplash

Just like that, a surprise Presidential post of potential new tariffs triggered a widespread market panic on October 10, 2025, sending shockwaves through risk assets. In thin, end-of-week liquidity, a single digital message led to the liquidation of over $19 billion in leveraged positions, the largest liquidation event in crypto history. The mechanics were textbook: automated selling hit already-thin books; long-heavy derivatives flipped into margin calls; forced liquidations chased prices lower; order books thinned further; more liquidations followed. A deleveraging spiral, fast, mechanical, and brutal. Bitcoin fell roughly 14.6%, many altcoins dropped 30 - 60%, with some outliers (e.g., SUI) plunging as much as 80%, and total market cap fell from $4.1 trillion to $3.6 trillion. Just look at the acuteness of that downward move:

Retail investors collectively bore the brunt of the collapse. Retail had piled into high-leverage long perps on the back of fresh all-time highs earlier in the week across majors. When the market turned sharply, these positions were swiftly wiped out. Overall, the liquidation cascade unfolded rapidly - within 8 hours.

While this was the most violent crypto liquidation event ever, we’ve been here before. Notable prior flash crashes include:

May 2022 Terra-LUNA Collapse: This event involved the collapse of an entire crypto ecosystem, resulting in the loss of nearly $40 billion in market value in just a few days. It was caused by the algorithmic stablecoin TerraUSD (UST) losing its $1 peg due to a combination of large-scale withdrawals and market manipulation. The collapse triggered a broader market downturn, led to multiple crypto lender bankruptcies, and caused major financial losses for many retail investors.

April 2021 BTC Flash Crash: After Tesla halted BTC payments and China reiterated trading crackdowns, BTC dropped ~30% in hours; ETH and broader crypto slid even more, wiping out over $300 billion in market value and causing over $10 billion in liquidations.

June 2017 ETH Flash Crash: The Ethereum flash crash of June 21, 2017, was caused by a single, multi-million-dollar market sell order on the GDAX exchange. The massive order led to a chain reaction that dropped the price of ETH from approximately $319 to $0.10 in a matter of milliseconds before it quickly recovered. Many traders who used margin accounts or had stop-loss orders in place lost significant amounts of money as their positions were auto-liquidated at extremely low prices.

Flash crashes are not unique to crypto and have shaken markets across all asset classes. For instance:

The 2010 Flash Crash (Equities): On May 6, 2010, the Dow Jones Industrial Average plunged by more than 1,000 points in about 10 minutes, wiping out roughly $1 trillion in equity before recovering much of the loss within the hour. A key trigger was a large, automated sell order for E-Mini S&P 500 futures contracts by a single mutual fund. This initial selling was then amplified by HFT algorithms, which created a rapid domino effect that withdrew market liquidity and caused a price collapse.

The 2014 “Flash Rally” (Bonds): On October 15, 2014, the yield on the 10-year Treasury note saw unprecedented volatility, briefly dropping 16 basis points and then recovering in just minutes. U.S. Treasury securities are typically stable, making this sudden swing particularly shocking. No single factor was identified, but a report by multiple government agencies suggested a "perfect storm" of factors, including automated trading algorithms, a drop in market depth, and disappointing economic data.

The 2016 British Pound Flash Crash (Forex): On October 7, 2016, the value of the British pound dropped over 6% against the U.S. dollar in a matter of minutes during Asian trading hours. Factors contributing to the crash included low liquidity in the market during Asian hours and comments from French President Francois Hollande regarding the UK's "hard Brexit". Automated trading algorithms likely amplified the movement after reacting to negative news stories.

These crashes are painful and significantly disrupt markets, but from a basic history, we can reach a few reasonable conclusions and assumptions: 1) flash crashes happen across all asset classes; 2) these are unpredictable “black swan” events that can be triggered by a myriad of different factors, though the mechanism - leverage + automation + thin liquidity - is consistent; 3) markets typically stabilize and recover, though not without collateral damage; and 4) prepared risk frameworks can turn a catastrophe into a survivable (and sometimes opportunistic) event.

Three playbooks that worked on October 10:

To provide more details about those risk management approaches, we spoke with three crypto quant PMs, running options volatility, arbitrage, and momentum strategies, about their perspectives on extreme market moves and how they successfully navigated October 10.

#1. Options Volatility Portfolio Manager (“Mr. OPT”)

Mr. OPT - a veteran options trader of 30+ years across many asset classes and now most recently crypto - honed in on the behavior of crypto spot and perpetuals (in crypto, "perps" are a type of futures contract with no set expiry), noting that “for a variety of reasons…they just vanish”.

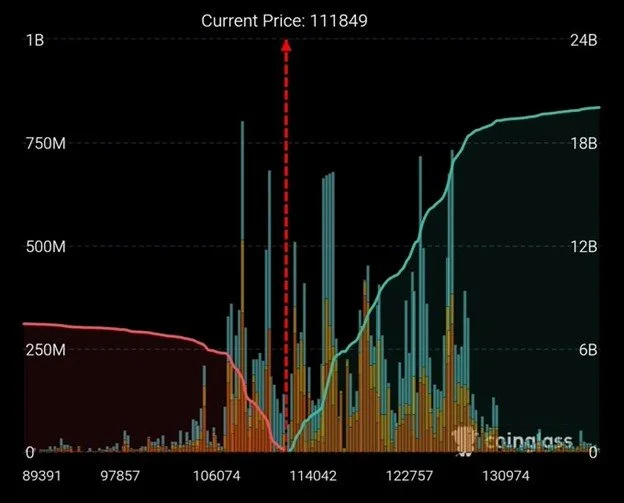

During such downward pressure, Mr. OPT is most concerned with “unhedgeable risk”, which means the book must be fundamentally structured correctly. He explained he is “never short puts and markets crash downwards, not upwards, and must budget that lopsided risk accordingly.” He added that all PMs must maintain the mindset that “trading is a job; it’s not about pushing risk; if you push that risk, especially in volatile markets, you will get killed. Take profits, prioritize downside protection, and be happy to leave some money on the table.” Underscoring his point, liquidations occurred at an estimated 7:1 ratio of longs to shorts, amplifying the speed and severity of the cascade once prices reversed, and a clear imbalance of longs versus shorts is seen here:

What felt different about this flash crash? Mr. OPT opined, “it seems the market needs less to tip into these crashes than used to, which could be a function of increased leverage, increased sensitivity to drawdowns, or thinner liquidity in after-hours markets (as more and more liquidity moves into traditional finance crypto products).”

Key takeaways:

Build for the unhedgeable

Treat trading as a job, not a “get rich quick” scheme

#2. Arbitrage Portfolio Manager (“Mr. ARB”)

Mr. ARB - a leading, delta-neutral crypto arbitrage PM since 2018 - said the event was “the craziest thing I’ve seen in crypto trading in my tenure. It wasn’t just the severity of the crash, with some alt coins crashing more than 50%, it was the velocity. Sure, there was some prior buildup during the day, but within 10 minutes, the market collapsed upon itself and open interest and market cap were wiped out.”

He emphasized that managing risk for crypto arbitrage strategies is ultimately about managing liquidation risk of collateral on exchange and technology risk. On the first point, “when employing cross exchange arbitrage and using exchange leverage, maintenance of collateral on exchange and exposure risk limits, particularly in fast-moving markets, are my primary concerns. If you are breaching limits, you should be selling all orders even if it’s at a loss to the model. Purely think: survival mode. Assume the market will cascade, take those relatively small losses, and get out.”

On the second point, “assume crypto exchanges and infrastructure and their APIs will break under severe pressure. This is why robust infrastructure is so critical on this side and why we embed sanity checks for prices, exposures, orders, etc. If the data on exchange does not line up with our system, there is a problem, and trading must be halted.”

Mr. ARB explained that he typically ends up making PnL during extreme pullbacks because “alpha generation is relatively easy compared to the risk management portion. By strictly adhering to risk limits, we limit losses in the initial washout, and then in the wake, scoop up arbs. offering advanced orders of magnitude that are now just floating due to the elevated liquidations and inefficient pricing patterns (as compared to more traditional asset classes). Typically, any losses from selling off are more than made up on the other side of the storm. At that point, we don’t need to even optimize execution because any transaction costs are small relative to the spread of the arb.; it’s just hunt and kill as long as still within our risk bounds.”

If he had to attribute his successful 7-year run trading through extreme crypto volatility to a single factor it would be “a paranoid, risk-first mentality. I look at these markets more like a trader than a quant. Expect worst-case scenarios, assume they will be even substantially worse than backtests could imagine, and plan for them. Money will be there to be made again, but only if you are in your seat with bullets. I assume catastrophe, avoid it because I assume it, and then exploit dislocated markets.”

Key takeaways:

Discipline over model pride

Assume venues break under stress

#3. Momentum Portfolio Manager (“Mr. MTM”)

Mr. MTM - a 10-year prop trading vet, who has been active in crypto trading since 2017 - also fared well during the October 10 crash, which he said was recognized by his model hours prior, and so the model began taking appropriate short positions. What were some of the confirmations recognized by the model? “Equities were already having a really bad day, and increasingly macro equity moves are correlated with macro crypto moves, particularly on the most extreme days; it’s just the panic and resulting downside risk in crypto is much higher. The lead lag was pretty clearly there on this day. We also observed a lack of minimum buying pre-crash; any positive moves lasted no more than 5 - 10 minutes before they were whacked back down by sell pressure.”

Expanding on his thoughts about crypto panic, Mr. MTM said, “it’s exacerbated because of a less mature market with fewer fundamentals. In equities, you can crash, but there is considerably more stability on the downside because of robust market structure and the underlying principle that these are real companies with fundamental valuations. Equities typically don’t go to 0. There is obviously much less confidence in the strength of crypto assets, so when the market pukes, over-panic sets in, and liquidity vanishes quickly, driving even more panic.”

During moments of downturn and panic, Mr. MTM explained that he is most focused on liquidity management (on exchange) and exposure management (to exchange), which is complicated due to lower liquidity and more fragmentation than traditional markets. On why he succeeds during these periods of market stress, Mr. MTM echoed his PM peers, “It’s really all about mindset. If the strategy is well designed with proper execution, it should not be fickle to environmental changes, which is obviously critical in a high volatility asset class. But managing the downside risk is everything, and even if the strategy is performing well, the market can still fundamentally break around it. It’s OK to lose small amounts of money, even if you are wrong; it’s not OK to take meaningful losses when there are market signals and the risk far outweighs any return potential. I’ll add planning and decisiveness to the mindset. Plan for market and operational failure, stress test mitigants, and act without emotion in accordance to risk limits and market conditions.”

Key takeaways:

Liquidity & exposure management above all

Prepared mindset beats bravado

Conclusion

A striking similarity between all the PMs that we spoke with is that they believe that volatility - especially on the downside - is a feature of crypto’s current market structure, not a bug. The managers who survive and compound over time share the same DNA: paranoid risk design, automatic discipline, and a cool head when screens go crimson. It’s not a matter of “if “there will be more black swan crashes and micro dumps; it’s “when”, and this inevitability must factor into the design of their strategies and execution, albeit in different ways for different strategies. The PMs also agree that:

Crypto liquidity is thin and vanishes quickly in higher-panic, less mature markets;

Downside risk management should be prioritized over alpha generation at all times;

Risk management is both a defined program and a built-in mindset;

There is increased correlation between traditional markets and crypto markets;

Liquidity, exposure, and technology management underpins risk management priorities during periods of stress;

Exchange technology still has weaknesses, which will surface in crashes.

The risk curve may be different from that of other asset classes, particularly on the sharp way down, but through recognition, preparedness, proper tools, experience, and a cool head, the best crypto quant traders have the proven ability to handle the outsized volatility. Track records support the statements, and mindset drives the methods.

Of course, manager quality matters, and these PMs represent the “best-of-the-best”. Diligence to identify the right strategies takes work, and as always, we recommend a diversified approach. No single strategy is ever a silver bullet in any environment, but a diversified set of quant strategies can provide an investment solution that offers conscious risk management and volatility control, sustainability across all market conditions, and a long-term outlook that seeks to protect capital first and then compound it when the market is not blowing up.

The Crypto world is evolving. Investors should evolve, and upgrade their approaches too.